Presenting the 2023 Partech Africa Report: A Rough Year for the Ecosystem

January 23rd, 2024

Also available in:

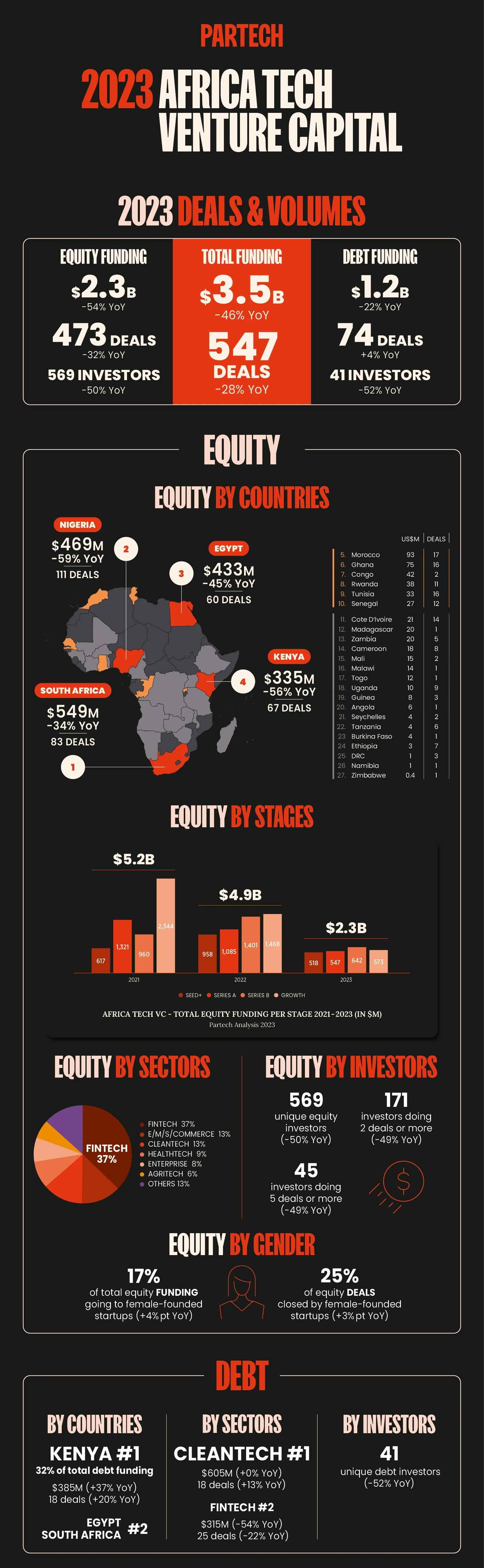

- In line with the global VC downturn, the African tech ecosystem raised a total of $3.5B, a decrease of -46% versus 2022.

- The African ecosystem saw a massive retreat from investors with -50% decrease in unique participating investors.

- Francophone Africa stands out with a 3% increase in participating investors and a 16% increase in deal count.

- Debt is confirming to be a solid alternative source of capital for African tech startups in 2023, representing 35% of the total $3.5B vs 24% of last year’s funding.

Paris, January 23rd, 2024. Partech Africa, the VC fund dedicated to technology startups in Africa, has issued its annual Africa Tech Venture Capital report. The report, which aims to provide a comprehensive and in-depth view into the evolution of the Africa Tech VC ecosystem, reveals that, in line with the global downturn in venture capital funding, the African tech sector saw a significant slowdown in 2023, securing only half the amount of funding it did in 2022.

In 2023, African technology startups secured $3.5B in total funding (equity and debt combined), marking a 46% decrease from the previous year, spread across 547 deals (-28% YoY). The report sheds light on the resilience of debt funding. Despite a 22% drop in the total amount raised from $1.6B in 2022 to $1.2B in 2023, the sector showed resilience with a modest increase in the number of debt deals from 71 in 2022 to 74 in 2023.

“Two years into the global downturn, it’s clear the African tech ecosystem is experiencing the full severity of it even though it’s faring much better than the Latin America and Southeast Asia regions” explains Cyril Collon, General Partner at Partech. “Despite this correction, over the last 10 years, the African tech ecosystem has still grown nearly 10x in transactions and funding amount with about $20B invested in roughly 3,000 deals, 68% of it in the last three years”.

Focusing on equity funding, the report notes a general downward trend impacting all aspects of investment.

First, the African tech ecosystem saw a massive 50% decrease in active investors (569 vs 1,149 in 2022) and a similar 49% decrease in highly active investors who participated in 5+ deals. In the VC downturn, many investors disappeared from the market, leaving startups with fewer options.

Looking at the stages of investment, the report notes the largest drop at the Growth stage, where the average ticket size fell by another 31% YoY in 2023 to $34.7M following last year's severe -50% drop. The Seed and Series A stages experienced drops of 8% and 16% respectively, compared to their 2022 averages. In contrast, the Series B stage maintained a steady average deal size at $18.9M, consistent with the previous year.

South Africa, Nigeria, Egypt and Kenya are still making the top 4 for African VC investment, with their contribution to the total volume amounting to 79%, despite a slight decrease in deal count with 68% of all deals (vs. 77% in 2022).

South Africa emerged as the leader of the African tech funding landscape securing $548M in equity, despite a 34% YoY decrease. However, when combining equity and debt, Kenya takes the leadership with $719M raised, thanks to the largest debt haul.

Nigeria, although it experienced a significant 59% drop in total equity funding to $468M, remained at the forefront in terms of the number of equity deals. Egypt faced the most substantial impact among the top four, with its equity deal count plunging by 58% to just 60 deals.

Outside of the top 4 countries, Morocco and Ghana are the only other countries surpassing the $50M equity funding threshold.

Francophone Africa stands out, with 52% of the countries (vs. 46% in 2022) that have seen a transaction in 2023, i.e., 14 countries out of 27 countries. This region takes a growing share of equity investment in Africa: 15% of the 2023 funding (vs 11% in 2022) and 20% of transactions (vs 12% in 2022), representing two thirds of the equity funding and deal counts outside the top four markets.

“In this dry market, the African tech ecosystem paid much more attention to Francophone Africa growing its share of transaction and funding” comments Tidjane Deme. “The steady growth of this region over the last years is explained by the ability of local investors - who drive more and more of the ecosystem - to expand beyond the top markets visible to global investors. They see the untapped opportunity in Francophone countries.”

Fintech held its position as the leading sector in the African tech ecosystem, being the first both in deal count, with 113 deals, and in funding amount with $852M, i.e. 37% of the total equity investment. e-commerce and cleantech tie for the second spot, commanding each 13% of the total funding amounts.

Female-founded startups raised 25% of equity deals, up 3 percentage points (p.p.) from 2022. They accounted for $392M (-39% YoY) or 17% of the total equity funding (+4 %p.p. YoY) marking a modest shift towards gender diversification among recipients. But when it comes to debt, female-led startups only account for 2% of the funding.

Lastly, debt is confirming to be a solid alternative source of capital for African tech startups in 2023, representing 35% of the total $3.5B, a jump of 11 percentage points compared to the 24% of 2022. The debt funding is led by Kenya (32% of total debt funding) and focused mostly on Cleantech (50%) and Fintech (26%).

To download the full ‘2023 Africa Tech Venture Capital’ report, click here.

-ENDS-

For media inquiries:

Isabelle Tresson: +33 7 86 08 85 85 itresson@partechpartners.com

About Partech Africa

Headquartered in Dakar, Senegal, Partech Africa is a leading VC fund dedicated to technology startups in Africa. Partech Africa focuses on series A and B equity rounds in startups which are changing the way technology is used in education, mobility, finance, healthcare, delivery, energy, etc.

About Partech

Partech is a global tech investment firm headquartered in Paris, with offices in Berlin, Dakar, Dubai, Nairobi, and San Francisco. We are a team made up of independent thinkers. We are unconstrained by hype, trend or fixed ways of working. We believe in the power of alliance in action, working together and side-by-side with the founders we back, in the shared pursuit of success. We bring together capital, operational experience and strategic support for the entrepreneurs we back from seed through to growth stage. Born in San Francisco 40 years ago, today we manage €2.5B AUM and our current portfolio of 220 companies in 40 countries, across 4 continents.

SUBSCRIBE TO OUR NEWSLETTER