therulebreakersandrisktakers

View & Filter

AB Tasty

Applicative SaaS

France

AB Tasty is a global leader in feature management, experimentation and personalization solutions — enabling companies to, while maximizing impact, minimizing risk and accelerating time to market.

Advano

Industrial, Energy & IoT

United States

ADVANO offers a scalable silicon solution for Li-ion batteries, accelerating the renewable energy revolution. Founded in 2016, and a 2017 graduate of Y Combinator, ADVANO is a New Orleans-based company delivering a sustainable, scalable solution for lithium-ion batteries with higher energy density.

Agicap

Applicative SaaS

France

Founded in 2016 by three entrepreneurs from Lyon, Agicap develops and sells a SaaS platform for SMBs to manage and forecast their cash flows. Agicap allows business owners to build dynamic, reliable forecasts and have real-time visibility over their current and future cash position.

Akeneo

Applicative SaaS

France

Akeneo is a global leader in Product Information Management (PIM) solutions that enable retailers and corporate brands to deliver a consistent and enriched customer experience across all sales channels.

Akridata

AI/ML

United States

Akridata is a software program operator company that solves AI information logistics challenges of Autonomous Vehicles. Its cloud-managed, scale-out platform spans edge (high speed ingest, prep and prioritization) to core (tiered storage and access).

Alan

Financial Services

France

Alan is the first digital health insurance company in France, with the ambition to revolutionize health insurance by focusing heavily on improving user experience while providing an excellent price-quality ratio health plan.

Almentor

Applicative SaaS

Egypt

Led by repeat entrepreneurs and industry veterants who combined their expertise and unified their efforts to become pioneers in the learning industry, Almentor is the leading continuous learning platform in Arabic for GCC and North Africa.

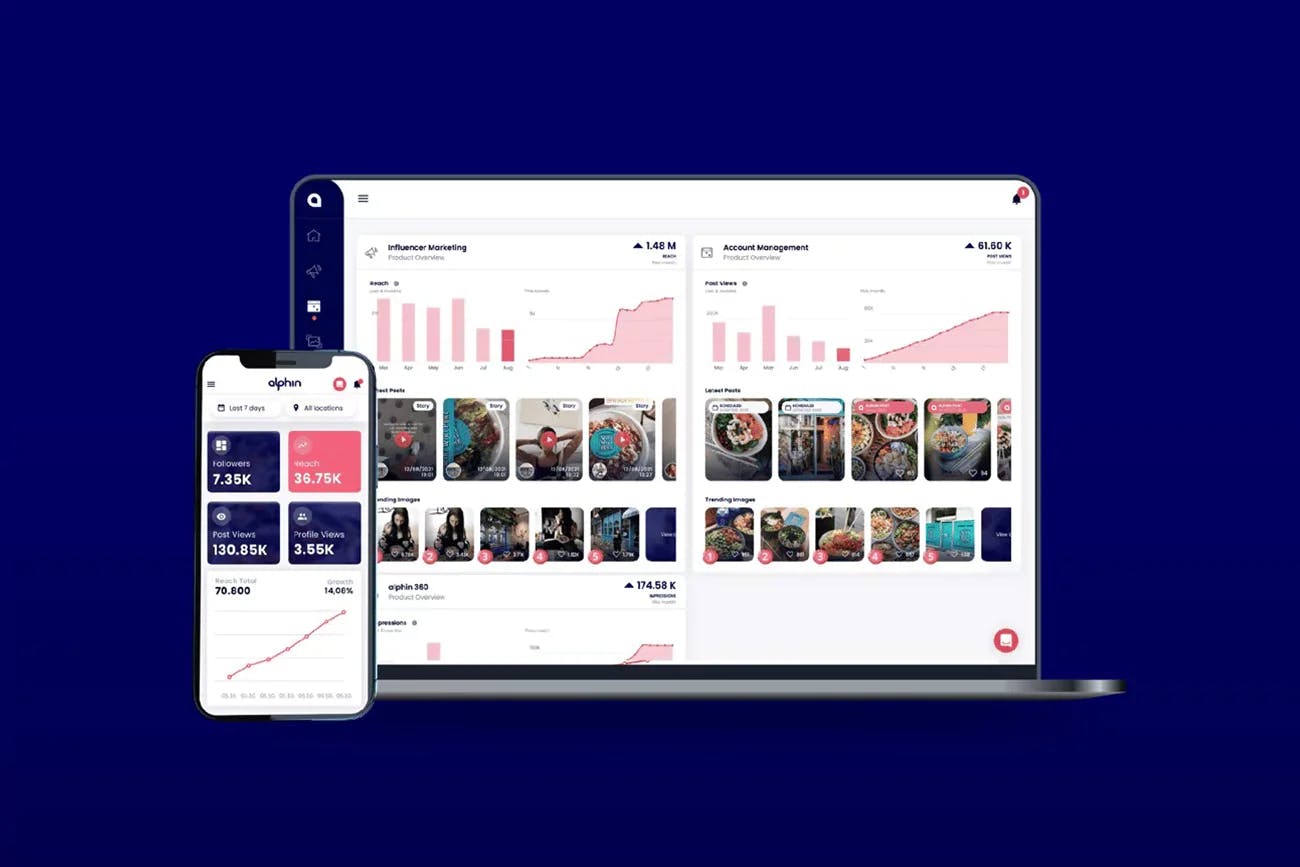

Alphin

Applicative SaaS

Germany

alphin is the leading marketing platform for local businesses in Europe. alphin provides local business owners with easy and affordable software solutions to centralize and automate their full customer lifecycle management.

Ambler

Healthcare

France

Ambler organizes the offer of the best providers (private ambulances and medical transportation operators and approved taxis) in order to meet the demand from healthcare institutions and individuals in a transparent and optimized way.

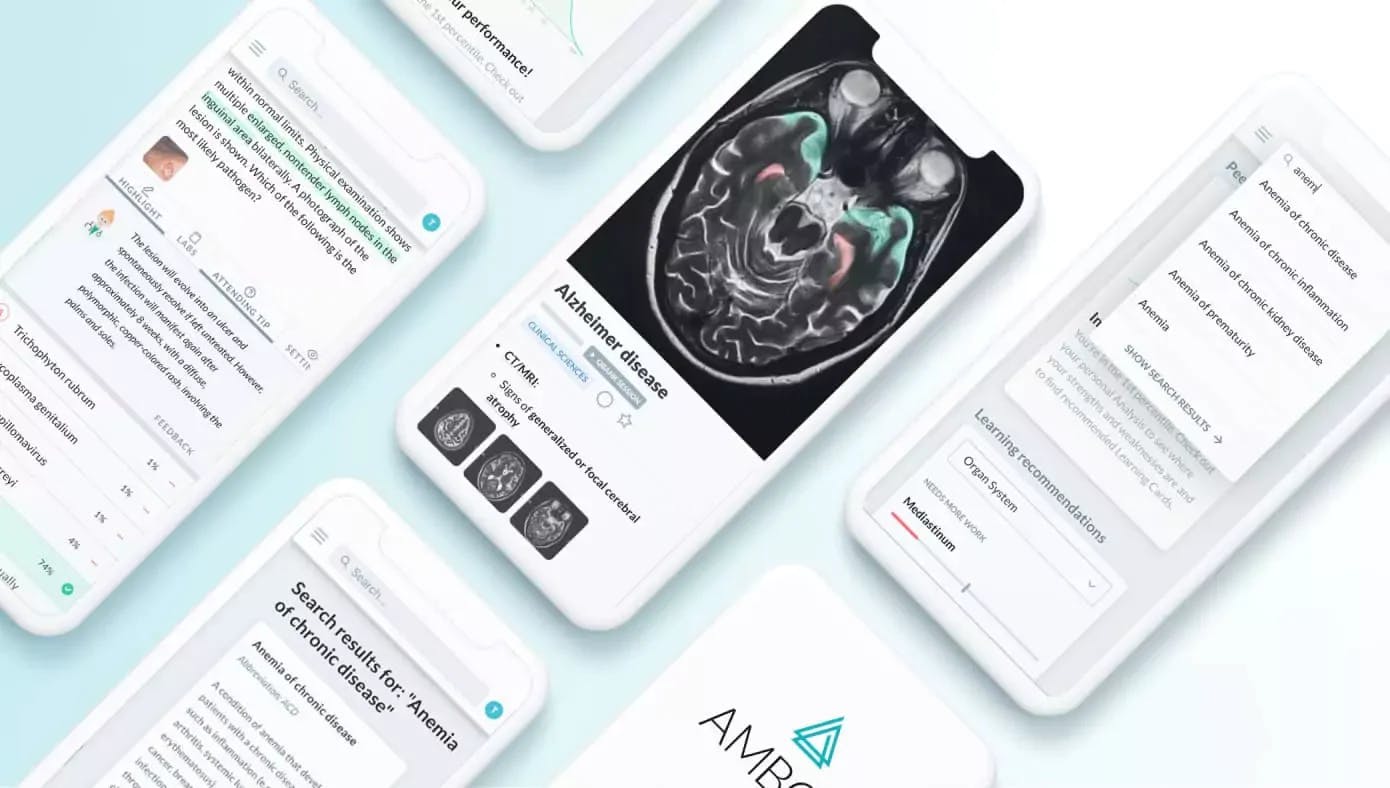

Amboss

Healthcare

Germany

AMBOSS is on a mission to empower all doctors to provide the best possible care. The company was founded in 2012 after a group of medical students who were finishing their exams found themselves spending more time researching medical information than they did studying it.

Apollo Shield

Infrastructure SaaS

United States

ApolloShield is the much needed solution to a growing problem that is becoming increasingly prominent in today's world. With the creation of drones comes the inevitable creation of another form of technology which must be regulated unless it is used by the wrong people.

Aumio

Healthcare

Germany

Aumio is the ultimate sleep and mindfulness app for children, helping them to grow up healthy, self-confident and less stressed. The child-friendly app is already enjoyed by more than 200,000 families in the DACH region.

Ava

Healthcare

United States

With so many dialogues going on simultaneously, it can be so exhausting and draining for those with hearing impairments to follow every conversation. Ava creates live subtitles that are clear and easy to follow, making the conversation more accessible for everyone.

Beam

Consumer

Singapore

Beam operates public e-scooter sharing service in Malaysia, South Korea, Australia, New Zealand and Taiwan, and are rapidly expanding.

Beam Checkout

Financial Services

Thailand

Beam builds One-Click Checkouts for Southeast Asia with a focus on social commerce. Based in Bangkok, they are working mostly with mid to large sized fashion, home and living and electronics sector merchants such as Bang & Olufsen, DJI Drones, Herman Miller, Leica, Rimowa, etc.

Bearer

Infrastructure SaaS

France

At Bearer, they are crafting the ultimate platform to help organizations build secure software that protects sensitive data. Data security and privacy are becoming major concerns for organizations as data leaks, data breaches and new privacy laws are commonplace.

Billogram

Applicative SaaS

Sweden

Billogram was founded in 2011, and has from the very beginning aimed to replace outdated payment processes and paper invoices with new, digital alternatives.

Bitrise

Infrastructure SaaS

Hungary

Bitrise is the leading mobile DevOps platform, used by mobile product organisations to move faster and more confidently. Founded in 2014, Bitrise is the world’s first mobile DevOps platform and built specifically to address mobile’s challenges and empower mobile teams to deliver their best work.

Blendid

Food & Agritech

United States

Blendid builds robotic and AI-enabled food automation solutions. The company’s first product, a fully autonomous robotic kiosk, crafts healthy and delicious smoothies that are made fresh-on-demand.

Blink

Applicative SaaS

United Kingdom

Blink is the world’s best app for frontline workers, driven by a mission to revolutionize life for the frontline so they can revolutionize the organizations they work for. Used daily by over 200,000 frontline workers at industry-leading companies including Stagecoach, Elara Caring and Domino’s.

Brevo

Applicative SaaS

France

Brevo, formerly known as Sendinblue, is the leading CRM suite designed to fully cultivate long-term customer relationships to empower businesses to expand in a fast changing digital world. With Brevo, businesses have a unified view of the customer journey in one easy-to-use platform.

Bugcrowd

Infrastructure SaaS

United States

Bugcrowd is the #1 Crowdsourced Security Platform. More enterprise organizations trust Bugcrowd to manage their bug bounty, vulnerability disclosure, and next-gen pen test programs.

Candex

Financial Services

United States

Candex is a venture backed fintech company that lets companies engage track and pay their tail vendors in a simple and efficient way. The easy way to engage, track, and pay. Candex solves the tail spend problem.

Channable

Applicative SaaS

Netherlands

Channable’s intelligent, scalable, and simple-to-use solution for data feed management and pay-per-click (PPC) automation seeks to empower online retailers, brands, and agencies to sell, market, and advertise their products globally.

Chatdesk

Applicative SaaS

Nigeria

Chatdesk is a cutting-edge customer support and relationship platform transforming the way brands interact with their customers. It helps companies maximize the ROI of any of their written customer interactions by leveraging AI and utilizing c. 50k local brand experts in 60+ languages.

CO2 AI

Climate

France

CO2 AI is the leading end-to-end sustainability management software solution helping large and complex organizations measure their impact, identify credible levers and reduce at scale, leveraging the power of AI.

Coachhub

Applicative SaaS

Germany

Coachhub is the only digital coaching provider that offers holistic people development to forward-thinking companies operating around the globe to transform their business in an age of digitalisation and constant change.

Collectiv Food

Applicative SaaS

United Kingdom

Collectiv Food is the new sourcing and delivery partner for foodservice businesses in London. They are disrupting the old-fashioned, inefficient and opaque supply chain of the food and beverages wholesale industry and leading the way to a fairer, more efficient and transparent food supply chain.

Commsignia

Industrial, Energy & IoT

Hungary

Commsignia is the largest company focusing on vehicle-to-everything (V2X) technology. Making transportation safer, more sustainable and more convenient.

Crossing Minds

AI/ML

United States

The smartest platform powering perceptive recommendations that drive online discovery and engagement. Crossing Minds is creating a universal recommendation platform that can be integrated into your business with minimal effort.

(LOAD MORE)

SUBSCRIBE TO OUR NEWSLETTER