2025 PARTECH AFRICA TECH VC REPORT: AFRICAN TECH FUNDING REBOUNDS TO US$4.1B

January 22nd, 2026

Also available in:

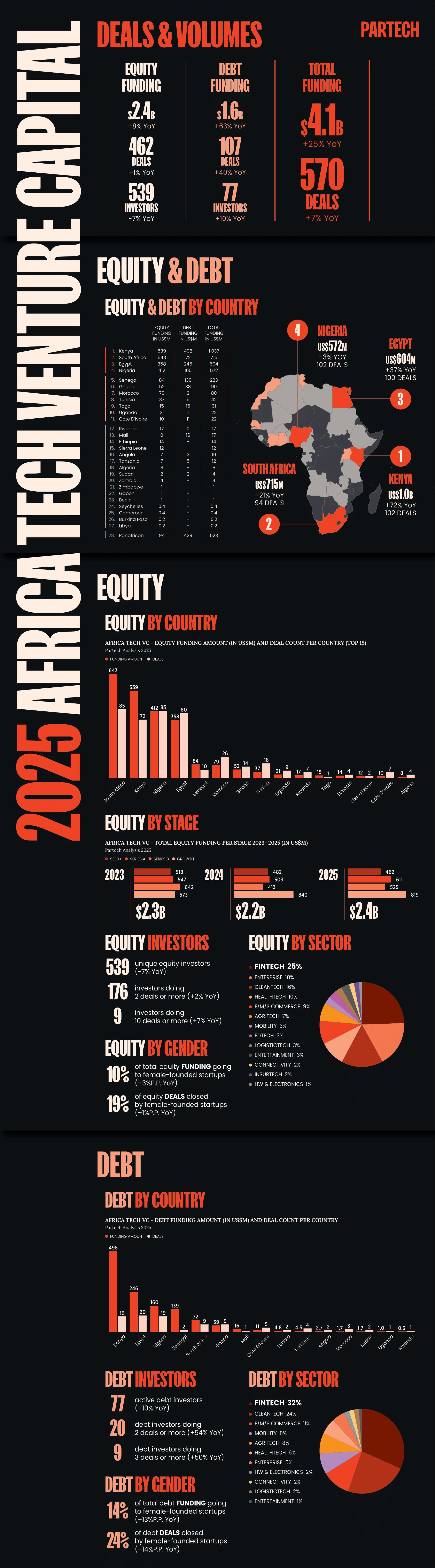

- African tech startups raised US$4.1B in 2025 (+25% YoY), marking the ecosystem’s strongest year since 2022.

- Equity funding reached US$2.4B (+8% YoY) across 462 deals, while debt funding hit a record US$1.6B (+63% YoY), confirming debt’s growing role in African startup financing.

- Deal activity grew to 570 transactions (+7% YoY), reflecting renewed momentum after two years of contraction.

- Kenya led the continent in total capital raised (US$1.04B), powered by its dominance in debt and four of the nine megadeals recorded in 2025.

- South Africa reclaimed full leadership in equity investment in 2025, topping both funding and deal count for the first time since 2017, supported by sustained deal flow.

- Fintech remained the largest equity sector, though its share declined amid rising investment in cleantech, healthtech and enterprise solutions.

- Female‑founded startups increased deal activity (+8% YoY) but still captured a limited share of overall capital.

Paris, January 22, 2026 - Partech, the global technology investment firm, has released its annual Africa Tech Venture Capital Report, delivering one of the most comprehensive analyses of the continent’s tech funding landscape. Based on fully disclosed, partially disclosed and confidential data, the report provides an in‑depth view of a fast‑evolving ecosystem that continues to mature, adapt and chart its own trajectory.

In 2025, African tech funding regained significant momentum, recording US$4.1B in combined equity and debt financing (+25% YoY). This marks a decisive shift after the global and regional slowdown of 2023–2024.

“This year’s rebound highlights the resilience of African founders and the growing sophistication of capital markets across the continent,” said Tidjane Dème, General Partner at Partech Africa. “Debt capital reached an all‑time high, with US$1.64B raised, and the number of debt transactions went from 77 to 107 deals (+39% YoY), marking the highest level of debt activity ever recorded. Meanwhile, equity markets stabilized, with meaningful recoveries at Series A and Series B. These indicators reflect a healthier, more mature ecosystem.”

Debt Drives Growth as Equity Stabilizes

Debt financing was the standout trend of 2025 with US$1.6B deployed (+63% YoY) and 107 debt deals recorded (+39% YoY), the highest level on record. Debt represented 41% of all capital deployed, up from 31% in 2024 and 17% in 2019.

While equity funding remained broadly stable (+8% YoY), deal sizes grew at every stage. Series A and B saw the strongest recovery, with average round sizes increasing 21% and 12% respectively.

Country Trends: Kenya Takes the Lead but South Africa Reclaims Momentum

Four ecosystems, Kenya, South Africa, Egypt and Nigeria, captured 72% of total capital, confirming the persistence of a hub‑driven VC landscape. While Kenya ranked first with US$1.04B raised (+72% YoY), supported by its ability to attract large debt rounds and multiple megadeals, South Africa regained leadership in equity deal flow. Nigeria remained highly active despite lower absolute volumes and Egypt sustained a strong pipeline with rising ticket sizes.

“2025 was the first year since 2017 in which South Africa led the way in terms of both equity funding and equity deal activity in Africa, with only one megadeal which represented 15% of total funding,” commented Cyril Collon. “This performance reflects a market where equity growth is driven by sustained deal flow across stages, rather than by a small number of outsized rounds and South Africa is the clearest example of equity-led normalization.”

Beyond the top four, Senegal, Morocco and Ghana were the only ecosystems surpassing US$50M in equity funding, underscoring the steep funding drop‑off outside the leading markets.

Francophone Africa strengthened its position outside the top four, capturing 68% of equity funding and 64% of deal activity—a notable increase from 2024.

Sector Trends: A More Diversified Equity Landscape

Fintech continued to dominate with US$769M raised (25% of equity funding), though its overall share declined. Other sectors saw significant growth: Cleantech: US$550M (+186% YoY), Healthtech: US$215M (+232% YoY), and Enterprise: US$238M (+55% YoY). This marks the first time since 2021–2022 that several non‑fintech sectors each exceeded US$200M in annual equity funding, signaling broader ecosystem maturity.

Founder & Investor Dynamics

Female‑founded startups increased their share of equity deals to 19% (+8% YoY) and captured 10% of total equity funding, though the overall gender gap remains significant.

Investor participation narrowed again in 2025 (-7% YoY), driven primarily by contraction at Seed+, while Series A and B saw renewed engagement. Investors also diversified beyond fintech, with increased activity across enterprise, cleantech and agritech.

***

-ENDS-

For media inquiries:

Isabelle Tresson: +33 7 86 08 85 85

About Partech Africa

Headquartered in Dakar, Senegal, Partech Africa is a leading VC fund dedicated to technology startups in Africa. Partech Africa invests in equity rounds from Seed to Series C in startups which are changing the way technology is used in education, mobility, finance, healthcare, delivery, energy, etc.

About Partech

Partech is a global tech investment firm headquartered in Paris, with offices in Berlin, Dakar, Lagos, Dubai, Nairobi, and San Francisco. We are a team made up of independent thinkers. We are unconstrained by hype, trend or fixed ways of working. We believe in the power of alliance in action, working together and side-by-side with the founders we back, in the shared pursuit of success. We bring together capital, operational experience and strategic support for the entrepreneurs we back from seed through to growth stage. Born in San Francisco 40 years ago, today we manage €2.7B AUM and our current portfolio of 220 companies in 40 countries, across 4 continents.

SUBSCRIBE TO OUR NEWSLETTER